Auditor-Acct-Financial Advisor Abandon's Ship Then Gov's Board Rolls Back Proposed Increase

Posted September 11, 2018 11:59 pm

COLUMBIA COUNTY, FL – Last night's Lake Shore Hospital Authority budget hearing had Columbia County residents wondering if the Governor's Board was going to hang tough with the proposed 1.5 mil tax rate while the Authority was sitting on a cash hoard $10.6 million. The proposed rate would have raised another $3.8 mil. After 58 minutes of discussion, the Board lowered the rate to .962 mils, the traditional rate for the past few years.

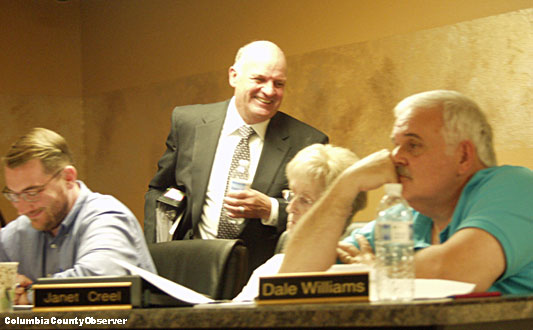

Auditor-Accountant-Financial Advisor Takes a Powder

Richard Powell heads for the exit.

Just before the budget hearing got underway, the Lake Shore Hospital Authority's long time auditor-accountant-financial advisor (all one person) Richard Powell bent over and whispered to Authority Manager Dale Williams, asking him if he could take care of the hearing. Manager Williams nodded yes.

A few minutes later, after some of the formalities of the meeting, Mr. Powell picked up his papers and began heading for the door. Board member Chancy called him back to his seat.

Mr. Powell answered a couple of questions and again picked up his belongings and high-tailed it out of the building.

No explanation was given for his sudden disappearance and none was asked.

Authority Manager Williams

Salaries and Pay Raises

Dale Williams introduces the budget.

Authority Manager Williams introduced the budget.

He explained, "The proposed millage may be reduced, however, it may not be increased. It should be noted that with the Authority, all the millage that's levied, or all the revenue from that millage must be allocated from one of two areas. It must be allocated to indigent care and/or hospital improvements. You can't use it to pay salaries and other things."

While the Authority has for years paid Authority salaries from the lease (rent) money, it was not obligated to do so.

Your reporter spoke with Manager Williams after the meeting and he said he would be correcting this at the second hearing on September 24.

Manager Williams continued, "We've placed all of the additional revenue into the emergency indigent patient services account."

"There's also an allocation of $3,500,000 in capital outlay. That is the estimated costs to replace all the roofs at Lake Shore Hospital... It may have to be adjusted up or down."

According to Manager Williams, the $3.5 mil includes repairs to the brick work on the hospital.

The triple-net lease requires the tenant, Community Health Systems (CHS), to make all repairs to the hospital, including structural repairs and everything.

The Governor's Board, so far, has disregarded letters from its own attorney which explain that the lease requires CHS to pay for the repairs.

Manager Williams announced that the budget does not include any employee pay raises.

Board member Joe Brooks asked, "Why have we not included any employee pay raises?"

Manager Williams answered, "During the workshop, employee pay raises were not discussed and no one indicated a need on the basis of what prior or other governmental entities were proposing. Therefore, we did not include any."

Lory Chancy makes a point.

Board member Lory Chancy said, "Our pay raises don't depend on what we tax."

Manager Williams responded, "That's correct."

Ms. Chancy added, "That would be a consideration."

Manager Williams followed up, "Excellent point... Salaries are paid out of the lease revenue from the hospital. If the Authority should decide to do that, then it's a simple budget amendment."

Mr. Brooks asked, "Are they based on performance reviews?"

Manager Williams responded, "I don't know what they've done historically. We did do a performance review this year."

The salary raises in most governments are settled before the agency's budget is approved and raises are approved in the respective budgets during the budget process.

It is not too late for Manager Williams to email Board members asking them to come to the September 24 budget hearing prepared to discuss and determine employee raises. This is the transparent and responsible course.

Lowering the Millage (taxes)

Ms. Chancy told the Board [as spoken], "As far as the 1.5 mils that we set. I think it needs to go back to what has already been stated, if we set 1.5 as the beginning of our discussion, then we can always decrease it. But I would hate for us to be on our second budget hearing and have put -- we're gonna' put nine -- point nine whatever mils as our lease and then find out that our expenses were 1 mil. By starting at 1.5 we can always decrease. I think that's something we all have to understand."

Janet Creel studies the budget.

Ms. Chancy then opined about the Authority paying for luncheons, which is not a legal expense for the Authority.

Board member Janet Creel mentioned something about the Authority paying for dental care, but no one seemed to know what she was talking about and she would not explain, other than making the remark, "People wouldn't tell me."

Jay Swisher moved to lower the millage rate.

Mercifully, after an hour, Board Member Jay Swisher moved to amend the tentative tax rate down to last year's rate of .962 mils.

Mr. Swisher told the Board, "I think that we fully operated within our budget last year. I also think that, as a board, the citizens of Columbia County have spoken pretty loud here recently. They don't want to see any tax increase. I think that it is prudent for us to maintain the .962.

Joe Brooks contemplates the budget

Mr. Brooks added, "I agree with Commissioner Swisher. If we keep it at 1.5 it's a little disingenuous to the public perception of what we're going toward... I want to communicate to the public: this is the direction that we're going in. It still could come down further in the next meeting."

Dr. Mark Thompson studies the lease.

Board member Dr. Mark Thompson had another lengthy remark, "I just want to read from the lease. (reads from sect. 6.4) For the next year we're probably going to be okay. But as we educate ourselves; as we study poverty; as we look at our obligations, that .962 isn't going to cut it. Especially if we're looking at roof-envelope. If we're looking at ER expansion; really meeting our obligation with the indigent care fund -- I don't think we're gonna' be fine at .962... We do not live in a wealthy county... With Obama Care going away, I can tell you the amount of people who are unable to pay is not shrinking."

Stephen Douglas studies the budget.

Board member Stephen Douglas recommended a 'fix-up' fund, "We set up something [a fund] so that we have a fund available to fix things as we see fit. I agree with Ms. Creel. I'm going to protect the asset that County owns."

Chairman Beil called the motion. It was unanimous.

The tax rate stands at .962 mils, at least until the next meeting, when, as Mr. Brooks pointed out, "The Board can lower it."