Florida TaxWatch: Growing Disparity in State and Local Taxes

Posted October 23, 2020 07:59 am

TALLAHASSEE, FL – Florida’s state and local governments collect $6,352 in tax revenue for each of the state’s 21.5 million residents, according to an annual analysis by Florida TaxWatch (FTW), the nonpartisan, Tallahassee-based taxpayer research institute.

While that’s the 12th-lowest tax burden in the nation and nearly $1,600 less than the national average of $7,844, the 2020 edition of How Florida Compares: Taxes indicates a growing disparity in state and local taxes.

Florida’s

per capita share of state government

revenues ($3,008) is 48th in the nation and,

according the report, its per-capita share

of state tax collections ($2,097) is 50th,

the nation’s lowest.

Florida’s

per capita share of state government

revenues ($3,008) is 48th in the nation and,

according the report, its per-capita share

of state tax collections ($2,097) is 50th,

the nation’s lowest.

Meanwhile, Florida’s per-capita share of local revenues ($3,344) ranks 16th in the country, and its per-capital share of local tax collections ($1,806) is the nation’s 28th highest, FTW calculated.

While the state ranks 38th in overall tax burden, 2020 marks the third consecutive year Florida’s ranking has slipped. Its 2019 per-capita state and local tax burden of $6,352 is $277 more than 2018, when the state was ranked 39th, and $673 more than in 2015, when Florida was 42nd in the nation in tax burden – or the eighth lowest.

Former state Sen. Pat Neal, the chairperson of Florida TaxWatch, weighed in on the new report.

“This annual report is an important tool for taxpayers, policymakers, and elected leaders at the state and local levels to better understand just how the Sunshine State stacks up when it comes to the cost of government,” Neal said. “Informed taxpayers keep government accountable, taxes in check, and are driving the growth of Florida as a premier choice for families and businesses.”

With the state facing as much $2.7 billion in revenue shortfalls over this fiscal year and next, FTW President and CEO Dominic Calabro said state lawmakers should examine the report closely to “prepare for tough budget decisions in the months ahead.”

“Today,” Calabro said, “it is essential that taxpayers and government officials at every level understand the true cost of government. The information presented in this report, especially regarding Florida’s heavy reliance on local taxes, should help guide decisions for Florida’s recovery.”

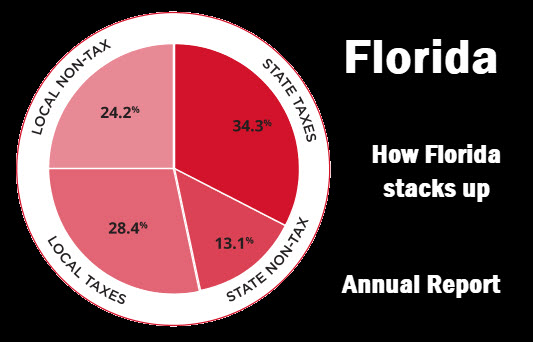

Florida relies more heavily on local revenues to finance government than almost any other state. Florida local governments account for 52.6% of Florida’s total state and local revenue, the second-highest percentage in the nation behind only New York.

The report, part of FTW’s larger How Florida Compares series, contains nearly 40 tables, graphs and charts that provide a comprehensive look at tax collections and other government revenues for all 50 states.

Among other findings:

• Florida’s per-capita property tax ranking is 25th. While state revenue collections began to improve in 2011, it took longer for local property taxes to recover. In 2014, property taxes finally began to reverse a trend of five consecutive years of declining collections.

• Florida classifies 37.3% of its state and local revenues as nontax revenue, or fees and user levies, the 11th-largest percentage in the nation.

• Florida relies more on sales taxes than most states, with 81.4% of all state tax collections from transaction levies compared with the national average of 46.5%.

• Florida has the nation’s highest state and local selective sales, or excise, taxes on utilities in the nation.

• Florida ranks 12th highest in nation in state and local cell phone tax rates at 14.86%, down from the fourth highest in 2015. The national average is 12.60 percent.

• Businesses pay 53.3% of all state and local taxes in Florida, the ninth-highest percentage in the nation and higher than the national average of 43.5%.

-------------------------------

This piece appeared in the The Center Square and was reprinted by the Columbia County Observer with permission or license. Images and layout added by the Observer.

By

John Haughey | The Center Square

By

John Haughey | The Center Square