FL DOT: High Mileage Cars Affecting Revenue

Posted April 1, 2014 04:05 am | 1 comment

Last Thursday's meeting of the North Central Florida Regional Planning Council (NCFRPC) brought guest speaker Mark Reichert to address the representatives of the counties and municipalities served by the Council. Mr. Reichert is the Assistant Executive Director of the Florida Transportation Commission (FTC), the citizen's oversight board of the Florida Department Of Transportation (DOT). The Commission's nine members are appointed by the Governor to maintain oversight and public accountability of the Department.

The FTC also serves as the nominating Commission in the selection of the Secretary of Transportation. The Governor appoints the Secretary from among three candidates nominated by the Commission.

Insightful and thought-provoking

Insightful and thought-provoking

Mr. Reichert's presentation was both insightful and thought provoking.

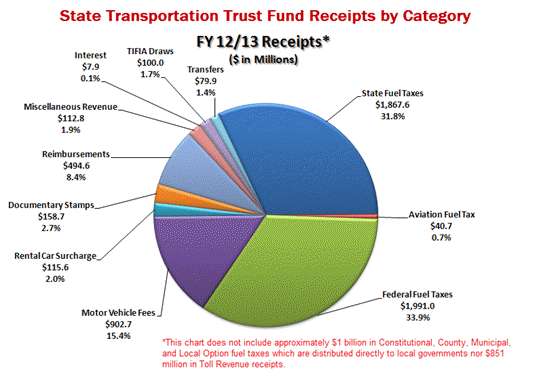

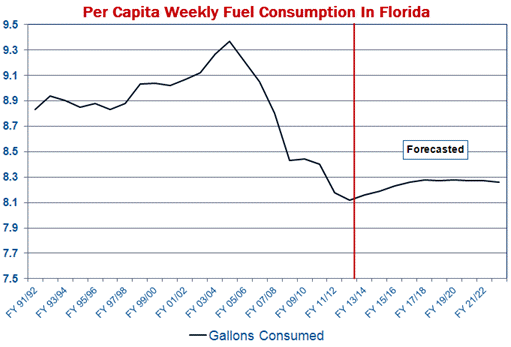

Mr. Reichert told the gathering, "In Florida, transportation revenue generated from fuel sales has declined as a result of impacts from both the economy and recession and the influx of more fuel-efficient vehicles. Between 1990 and 2005 fuel consumption increased an average of 3.4% each year. Since then it's decreased an average of 1.3% each year. Fuel consumption today is equal to the amount of fuel we were consuming in 2003."

He continued, "As the economy continues to recover from the recession and as the demand for gasoline and diesel fuel increases, transportation revenue generated from the sale of fuel will also increase."

However, Mr. Reichert warned there is trouble on the horizon because the FDOT budget is financed by fuel taxes. He said that we are not driving as much as we used to; the auto industry is not fighting higher fuel efficiency standards; and the Obama Administration is working on increasing the fuel standards on commercial trucks.

"Driving an electric vehicle is synonymous with splicing into your neighbor's cable system..."

Assistant Executive Director Reichert showed a slide with photos of high mileage vehicles and said, "Because these vehicles use little or no fuel, they pay little or no fuel taxes in support of transportation system. Driving an electric vehicle is synonymous with splicing into your neighbor's cable system so that you can have free access to cable TV."

According to Mr. Reichert, the State's fuel economists have not figured in the higher mileage standards in its fuel tax revenue forecast and because of that he believes that the $4.2 billion gap between actual and forecast revenue between 2006 and 2013 is much larger.

Mr. Reichert pointed to a graph that showed between 1993 and 2022 the purchasing power loss of the gas tax due to inflation is expected to be 51%.

Mr. Reichert said that the FTC and FDOT show that the monthly contribution of the average driver in Florida is $332.70 annually or $27.73 a month toward the State's transportation infrastructure.

Greg Evans: DOT's District 2 Director.

Mr. Reichert's presentation did not include the total amount of the Florida Department of Transportation budget. The Observer asked for the numbers. Mr. Reichert passed the question to DOT's District 2 Director, Greg Evans. While Director Evans couldn’t come up with an exact answer, after some back and forth between Mr. Reichert and Director Evans they got close.

A check with DOT's Pam Custer revealed that the FY 2015 budget is expected to be $9.7 billion (rounded off) and the present budget, FY 2014, is $9.4 billion. FY 2013's DOT budget was $8.2 billion.

Mr. Reichert commented on the problem of convincing folks "that fuel tax receipts are going down when the FDOT is going to be having a record budget year."

He said, "During the down years money was swept out of the Florida Transportation Trust Fund to fund general government. FDOT is getting some of that money back."

County and municipal road projects: no measure of success

On December 5, 2013, District 2's DOT office had its annual open house.

The Observer asked Rural Area Transportation Development Engineer, Jordan Greene, about rural county paving projects. "Do you ever rate the projects after they are done to see if they're successful, or do you pay to have it paved and just walk away?"

DOT's Greene answered, "We don't come back and do any kind of study. It's not a requirement... We do on system roads: Interstate and State Highway Systems... We can provide money to do traffic analysis if they feel that's warranted. Their local requirements aren't as stringent as our state requirements."

On Thursday night, the Observer explained that there are no follow-up studies by DOT of DOT funded county and municipal road projects and asked Mr. Reichert, "Why isn't there any follow-up on what happens with that money, or that road?"

Commissioner Reichert handed the question off to DOT's District 2 Secretary, Greg Evans.

Secretary Evans answered, "I have no idea what that question is about." He added, "Those investments are wise dollars spent."

Assistant Executive Director Reichert concluded by telling the folks at the Planning Council that if Florida is going to be able to take care of its transportation infrastructure needs it will not be able to continue to rely on the fuel tax as the State's primary transportation revenue source.

Graphics: Courtesy of the FTC

COLUMBIA

COUNTY, FL – Mark Reichert, Assistant Executive Director

of the Florida Transportation Commission, told the

Planning Council, "Driving an electric vehicle is

synonymous with splicing into your neighbor's cable

system." Looking forward, the Florida DOT is facing

serious funding issues.

COLUMBIA

COUNTY, FL – Mark Reichert, Assistant Executive Director

of the Florida Transportation Commission, told the

Planning Council, "Driving an electric vehicle is

synonymous with splicing into your neighbor's cable

system." Looking forward, the Florida DOT is facing

serious funding issues.