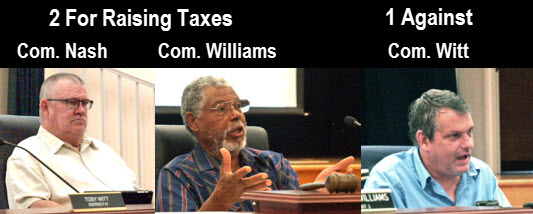

Com's. Nash & Williams Looking to Raise the Gas Tax, Com. Witt "I will not support a raise in taxes"

Posted May 17, 2019 07:00 pm

COLUMBIA COUNTY, FL – During yesterday morning's 9 a.m. first budget workshop of the year, it didn't take the County 5 long to begin talking about what all politicians love, raising taxes: at first, the gas tax.

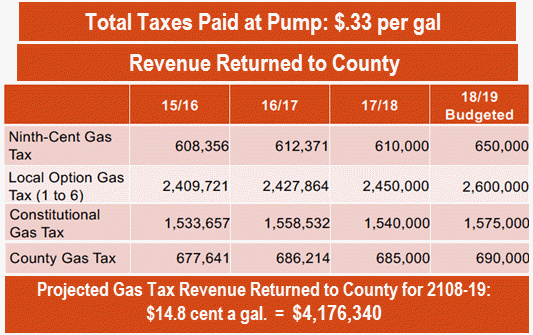

Anyone buying gas in Columbia County is currently paying 33 cents a gallon in Florida fuel taxes. The County portion of that tax according to the Florida Department of Revenue (DOR) is 14.8 cent gallon. (In the chart below, the revenue figures provided are from Columbia County.

County Manager Scott Explained the Gas Tax

"The thing with the gas tax – even though there's more cars on the road and people are driving more, it stayed relatively flat because of the efficiencies in the cars – they are just making better gas mileage cars. We haven't seen the increases [in tax revenue] we saw ten years ago."

Another Gas Tax Available

Three local option fuel taxes are available to the County.

A ninth-cent fuel tax of 1 cent on every net gallon of motor and diesel fuel sold within a county. This is already being collected.

![]() A

tax of 1 to 6 cents on every net gallon of motor

and diesel fuel sold within a county. Six cents

are already being collected.

A

tax of 1 to 6 cents on every net gallon of motor

and diesel fuel sold within a county. Six cents

are already being collected.

Gasoline: smells like money

A tax of 1 to 5 cents on every net gallon of motor fuel sold within a county. Diesel fuel is not subject to this tax. Although funds must be spent on transportation improvements, funds may also be used to meet the requirements of the capital improvements element of an adopted local government comprehensive plan.

The 1 to 5 cents is not being collected and at least two commissioners can smell the gasoline, and it smells like money.

Commissioner Nash: overcome by the fumes

Commissioner Nash announced, "I'm in. Any of you other guys in?"

Commissioner Williams joined, "I'm in."

Commissioner Nash followed up, "Well, I've got two."

Commissioner Murphy joined the conversation. He said something about a fish bowl and then went unintelligible. Mr. Murphy refuses to use the microphone, even showing distain for it by pushing it away from him. For a while he was getting easier to understand, but he has returned to his old ways.

Raising the Sales Tax: Here we go again

Commissioner Williams announced, "We need to revisit the sales tax. (This is officially known as the Charter County and Regional Transportation Surtax. It is a tax only available to charter counties and at a maximum rate of 1 %.)

This is the tax that was voted down last year, when it seemed to put the kibosh on the Hunter-Hilton (proposed new county jail).

On September 6, 2018, after the defeat of the Charter County and Regional Transportation Surtax, a tax that the County 5 called an infrastructure tax, Commissioner Williams announced that he would not support a jail that cost more than $25 million. See: For the County 5 & Sheriff Hunter, It's Time to Regroup: No New Taxes – New Jail on Hold

During the same 2018 meeting, County Manager Scott told The 5 that the way things stood all increases in County revenue would be going to fund the [new] jail.

Commissioner Witt: "I will not support a raise in taxes"

District 3 Commissioner Toby Witt would have none of it. He told The 5, "I will not vote to even consider it. I will not support a raise in taxes."

Commissioner Williams said, "The voter's will raise it, we won't. I think we should give them an option to do so."

Commissioner Witt responded, "You stick to that when you run for office."

Commissioner Williams replied, "I will. I don't back slide what I believe in."

Commissioner Nash said, "I'm open to it."

Commissioner Murphy opined, "It took away creditability from the jail project... I would want to do it in an off year in a special election."

Commissioner Williams said, "I'm a strong proponent of giving voters the option to approve or not approve a increase in a tax."

Epilogue

It will be interesting to see if Columbia County voters will get a vote on raising their gas costs.